Some Of Simply Solar Illinois

Some Of Simply Solar Illinois

Blog Article

Simply Solar Illinois for Beginners

Table of ContentsHow Simply Solar Illinois can Save You Time, Stress, and Money.See This Report on Simply Solar IllinoisThe Greatest Guide To Simply Solar IllinoisLittle Known Facts About Simply Solar Illinois.Simply Solar Illinois Things To Know Before You Buy

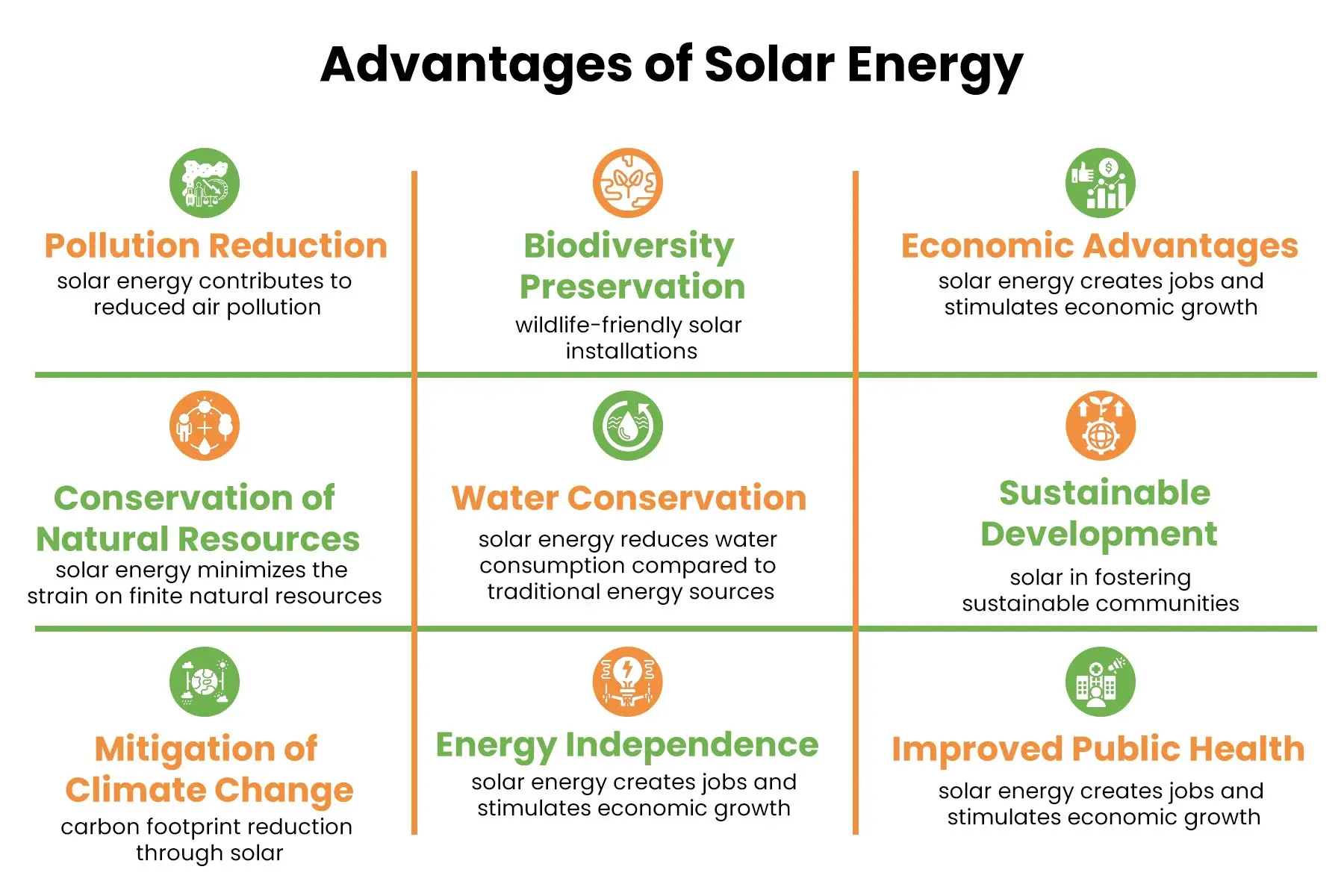

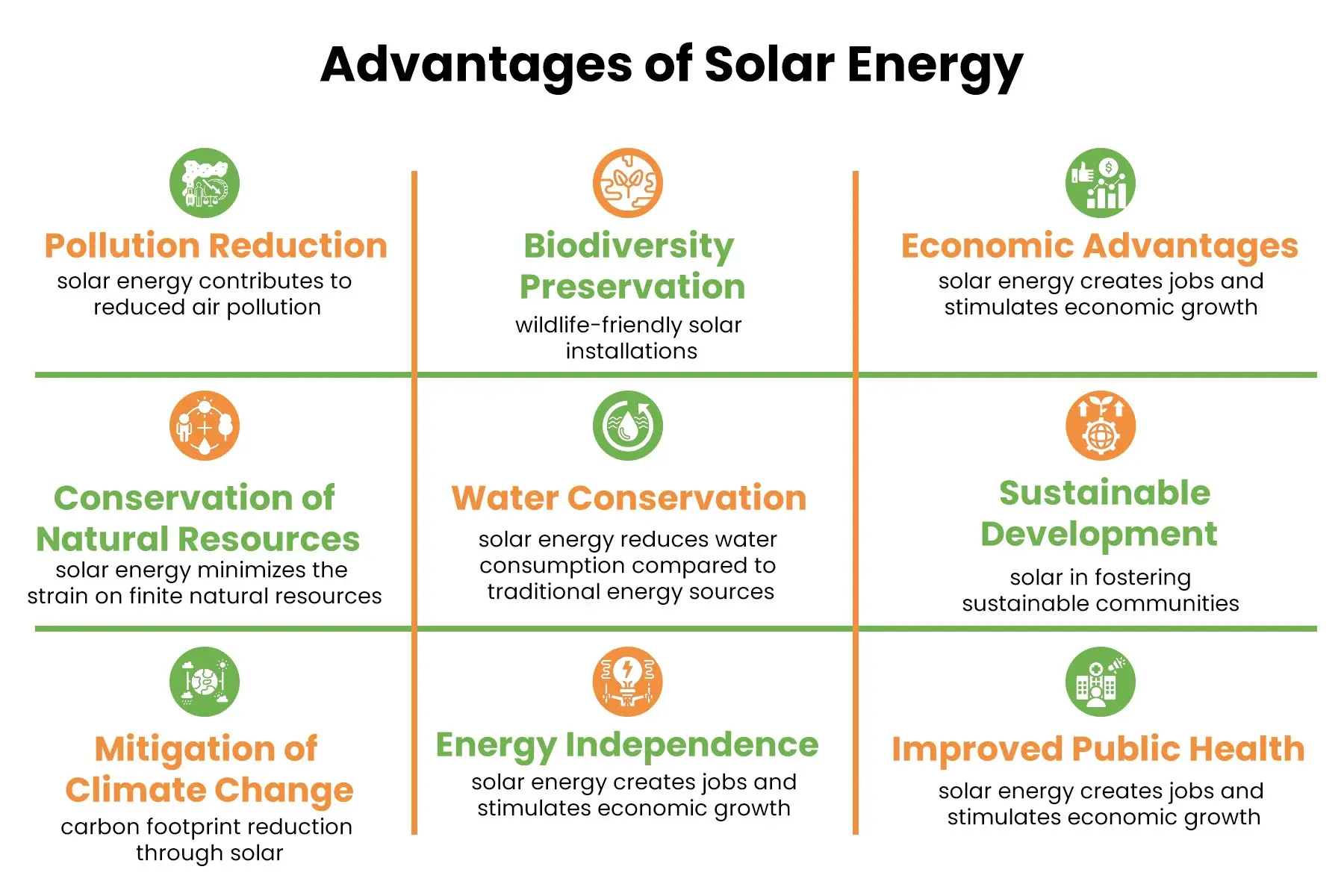

Our group companions with neighborhood communities across the Northeast and past to supply tidy, affordable and trusted power to foster healthy and balanced areas and keep the lights on. A solar or storage task delivers a variety of benefits to the neighborhood it offers. As technology developments and the price of solar and storage decline, the financial advantages of going solar remain to rise.Support for pollinator-friendly environment Environment restoration on infected sites like brownfields and garbage dumps Much required color for livestock like lamb and fowl "Land financial" for future farming usage and dirt quality enhancements Because of environment modification, extreme weather condition is becoming more frequent and turbulent. Because of this, property owners, services, neighborhoods, and energies are all coming to be increasingly more interested in protecting power supply remedies that supply resiliency and power security.

Environmental sustainability is one more key motorist for businesses buying solar power. Many business have durable sustainability objectives that include lowering greenhouse gas exhausts and making use of much less sources to assist lessen their effect on the all-natural setting. There is a growing urgency to attend to environment change and the pressure from customers, is arriving levels of organizations.

Not known Facts About Simply Solar Illinois

As we approach 2025, the combination of solar panels in business jobs is no longer just an alternative however a critical need. This blogpost dives into how solar power jobs and the diverse benefits it offers industrial buildings. Solar panels have actually been utilized on domestic structures for several years, yet it's only just recently that they're becoming more usual in industrial building.

In this write-up we talk about exactly how solar panels work and the benefits of using solar energy in business structures. Electrical energy costs in the United state are raising, making it much more costly for companies to run and a lot more tough to plan ahead.

The United State Power Details Management expects electric generation from solar to be the leading resource of development in the united state power field with completion of 2025, with 79 GW of brand-new solar capacity projected to come online over the following 2 years. In the EIA's Short-Term Power Expectation, the firm claimed it expects renewable resource's general share of electrical power generation to increase to 26% by the end of 2025

Some Known Questions About Simply Solar Illinois.

The sunshine causes the silicon cell electrons to propel, creating an electrical present. The photovoltaic or pv solar battery soaks up solar radiation. When the silicon connects with the sunlight rays, the electrons start to move and produce a flow of straight electrical current (DC). The cords feed this DC electricity right into the solar inverter and transform it to alternating power (AIR CONDITIONER).

There are numerous methods to store solar energy: When solar energy is fed right into an electrochemical battery, the chemical reaction on the battery parts maintains the solar power. In a reverse response, the current leaves from the battery storage read space for intake. Thermal storage space utilizes tools such as molten salt or water to retain and absorb the warmth from the sun.

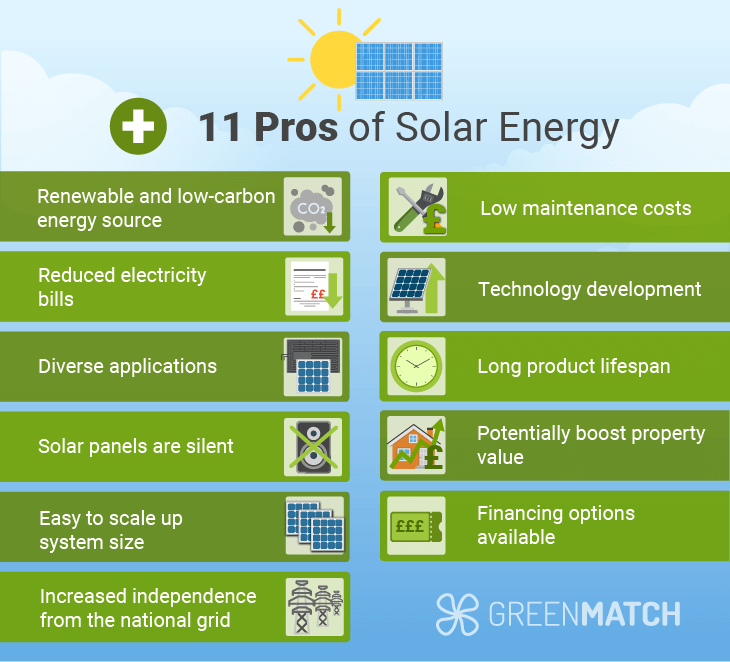

Solar panels dramatically minimize energy costs. While the first investment can be high, overtime the price of setting up solar panels is recovered by the money conserved on electrical energy expenses.

The Only Guide to Simply Solar Illinois

By setting up photovoltaic panels, a brand name reveals that it cares concerning the environment and is making an initiative to lower its carbon impact. Structures that rely entirely on electric grids are vulnerable to power failures that occur throughout poor weather condition or electrical system malfunctions. Photovoltaic panel installed with battery systems allow business structures to remain to function throughout power outages.

What Does Simply Solar Illinois Do?

Solar energy is just one of the cleanest forms of energy. With resilient service warranties and a manufacturing life of approximately 40-50 years, solar financial investments contribute dramatically to environmental sustainability. This change in the direction of cleaner power resources can result in wider financial benefits, including decreased climate modification and environmental deterioration expenses. In 2024, home owners can take advantage of federal solar tax incentives, allowing them to offset almost one-third of the acquisition price of a solar system through a 30% tax obligation credit score.

Report this page